Worthy Bonds Review: Easy 5% Returns

Worthy Bonds are a relatively new financial product that have started to pick up a bit of interest recently. Their claim to fame is providing a fixed 5% rate of return to all investors. If you’ve been interested in looking into a way to diversify your investment portfolio, then take a look at this in depth Worthy Bonds review.

Get a free $10 bond today by using this signup link: Worthy Bonds .

About Worthy Bonds

Worthy Bonds are a product offered by Worthy Peer Capital, a subsidiary of Worthy Financial, Inc. This financial services has the mission of providing community based capital to growing companies. They are strong believers in “investing in each other” which I think is a very admirable cause. This allows even the smallest business owner being able to get the capital they need to get their business off the ground. This is the reason why I initially invested in Worthy Bonds myself.

In addition to helping lenders, Worthy Bonds also desires to help solve the American problem of not having savings in the bank. Because of the stability of the bonds, they are a great alternative to keeping your money in a regular savings account, which typically only offer returns of 0.06%. The 5% fixed return from the Worthy Bonds can help you grow your money over time.

How Do Worthy Bonds Work?

The bonds that you buy as a Worthy Bonds customer are used as a loan for companies that provide collateral such as inventory or accounts receivable to secure the funds. The companies pay interest on their loans, and indirectly, you collect a 5% fixed rate on the money that you’ve lent to the borrowers.

You have guaranteed returns on your loan, since the borrowers selected by Worthy are secured by assets having a greater appraised liquidation value than the loan amount.

Since Worthy Bonds began, there have been a few bond “portfolios”:

- Worthy Peer Capital II: The company just reached a milestone in fall 2020, and has sold $50 million worth of bonds. These bonds are fully sold out

- Worthy Community Bonds: The latest class of bonds offered by Worthy, these will also be sold until $50 million worth of bonds have been sold.

These bonds have a 36-year term and they act similarly to corporate bonds.

Worthy Bonds Features

What I really like about Worthy Bonds is that they are simple, like really simple. Here are a few of the simple features that you get as a Worthy Bonds customer:

Feature 1 | Cost: Each bond is $10, which really makes this an investment type available to anyone

Feature 2 | Accrued Interest: You interest accrues regularly, and with enough money in your account, you can see it accrue daily

Feature 3 | Round ups: When you link a debit card to your account, Worthy will monitor transactions and round up costs to the nearest whole dollar, then taking that amount and put it into your Worthy Bonds account. Once your roundup value equals $10, you’ll automatically purchase another bond.

Feature 4 | No Market Swings: Unlike bonds that you’d buy in your brokerage account, Worthy Bonds are impacted by market swings. This means you don’t have to worry about any changes to your rate of return over time.

Feature 5 | Liquidity: You can cash in your bonds at any point in time – without paying ANY fees!

Setting Up Your Worthy Bonds Account

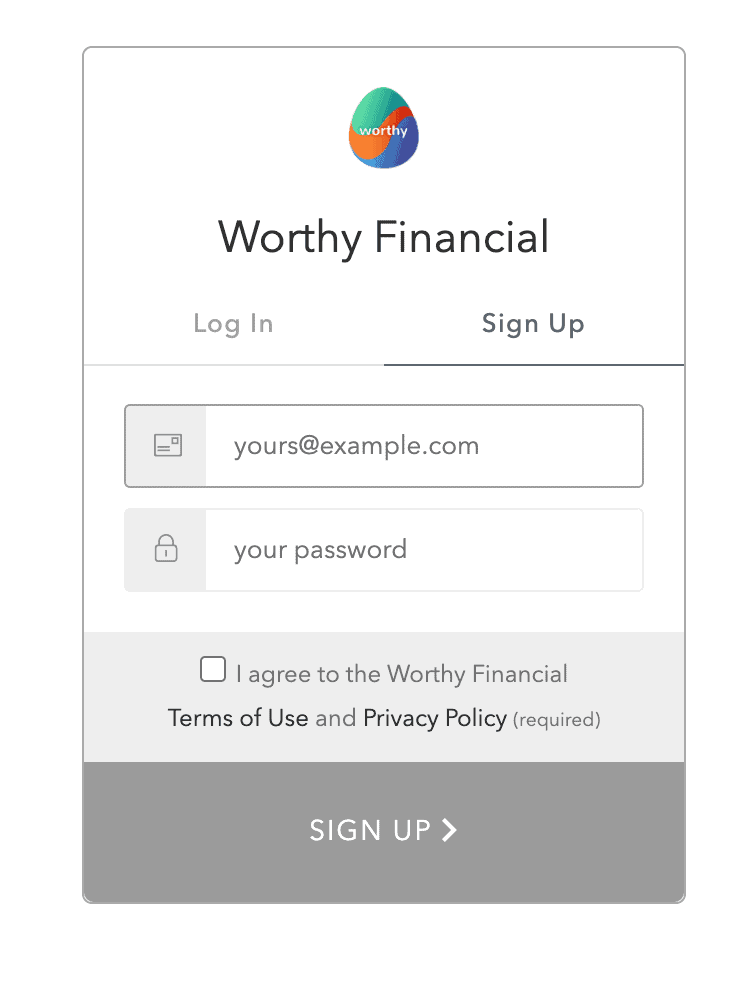

Getting your account set up is a pretty easy process. Here are a few of the initial steps:

- Click the “Get Started” button on the Worthy homepage.

2. Enter your preferred email address and a complex (safe) password.

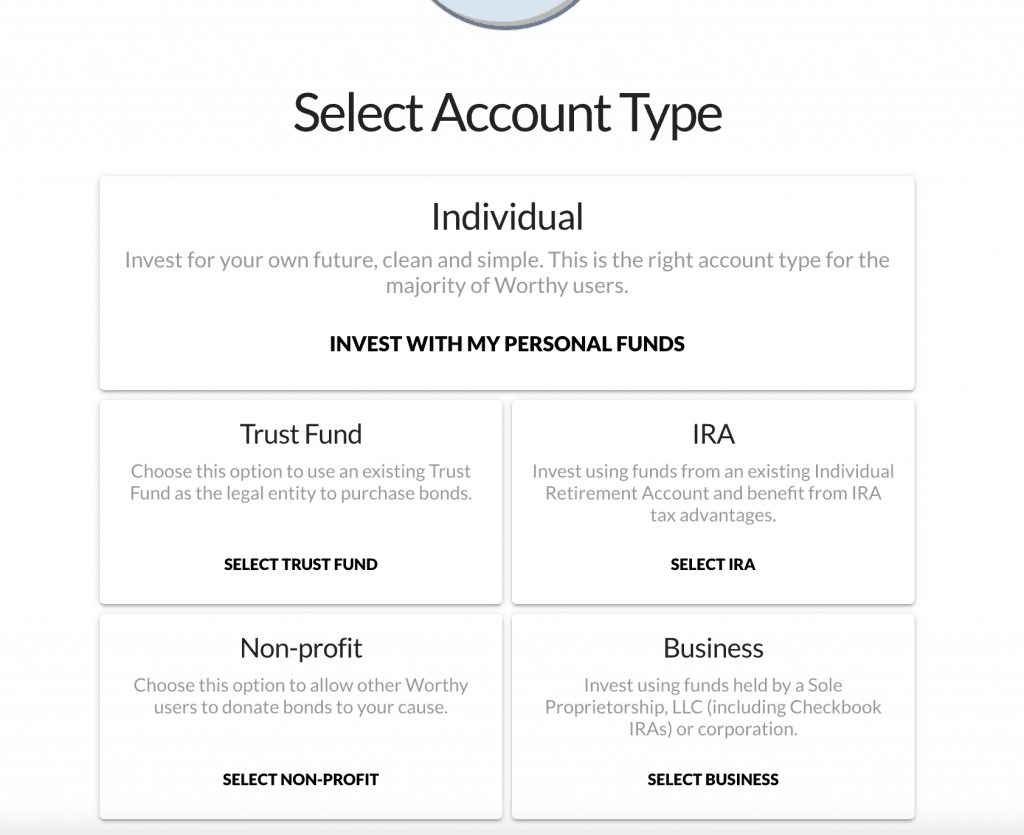

3. Next, you can choose which type of account that you’d like to set up. For most of you, this will mean opting for the “Individual” account. It should be noted, that as you can see here, Worthy Bonds can be added to your existing Trust Fund or IRA. This will allow you to diversify the funds that you have in each of those accounts further.

4. When setting up your account you’ll need to enter in all the standard information that you’d provide when setting up any other financial account.

Note, you HAVE to link a US bank account in order to set up your account, so you must have that information on hand.

5. Next, you’ll need to fund your account. I recommend starting out with at least $100, and then setting up a recurring investment on auto-pilot. Remember, any automatic savings you setup just make your potential for growing wealth that much stronger.

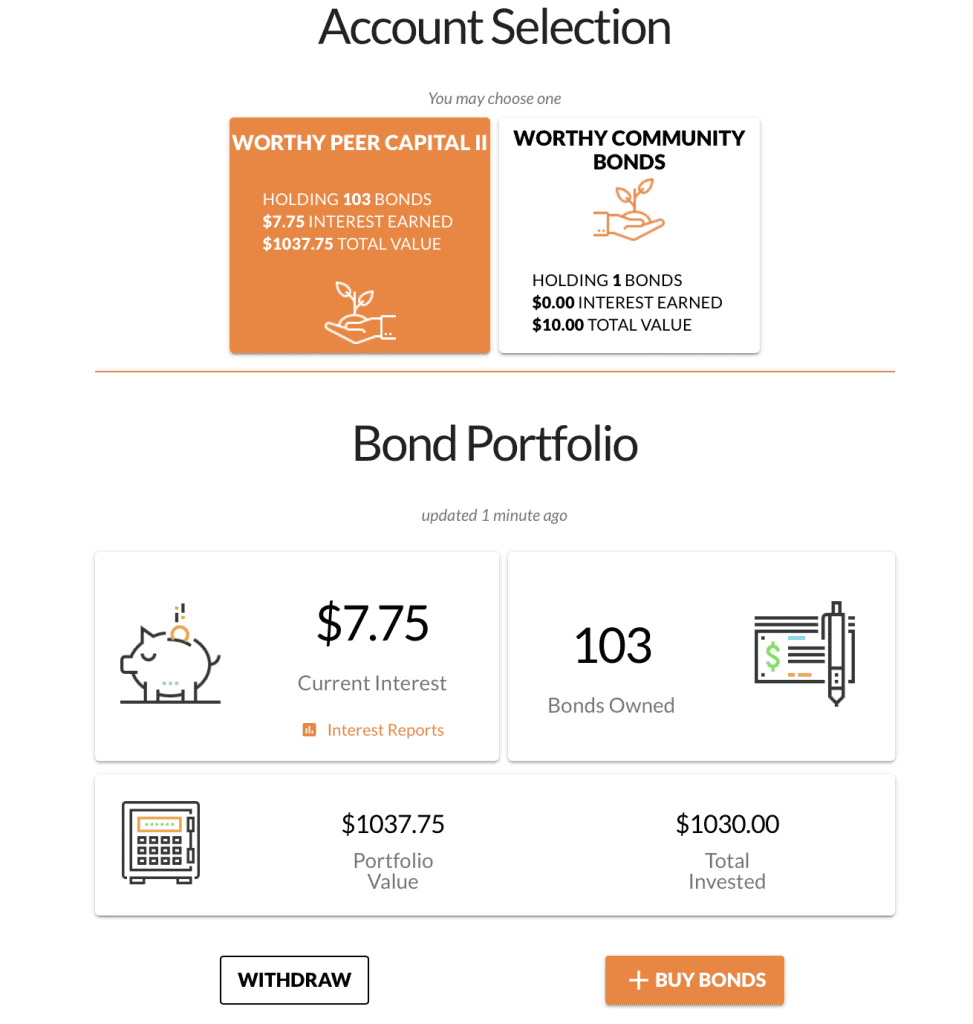

6. Once your account is funding, here is a snapshot of what your dashboard will look like. Remember that I told you it’s simple? The image that you get here is very clear. In one quick look, you know how many bonds you won, how much interest you’ve earned, and can easily toggle between bond portfolios (as applicable).

Withdrawing from your bonds or buying new ones is just a click away as well.

Benefits of Worthy Bonds

You may have gathered what the benefits of Worthy Bonds are by reading the first half of this review, but here they are in summary:

- Simplicity: It’s so simple to invest in Worthy Bonds that literally anyone could do it. This makes it an easy option to use to help get you novice friends started in investing too.

- Investment Portfolio Diversity: It’s a good thing to have a diversified portfolio – this will allow you to to hedge against the risk associated with investing your money in the first place. Essentially, you want enough diversification so that you don’t have to worry about the value of your investments going down all at the same time

- Better Than a Savings Account: If you keep all of your money in a savings account, your money will never beat the rate of inflation. By keeping your money in Worthy Bonds as an alternative to keeping a lot of money in your savings account, you will also hedge against the risk of your money losing value in the future

- Great Alternative to Market Bonds: Worthy Bonds aren’t impacted by the typical ups and downs of the market. Your rate of return will stay the same as long as you are invested in your bonds.

Cons of Worthy Bonds

It’s tough to find much to complain about on the Worthy Bonds, but here are just a few items to keep in mind as you consider investing in them:

Rate of Return Compared to Stock Market: 5% is a great return when compared to standard savings and some other investments, but when compared to investing in the full stock market, the return is lower. This is why it’s great to be a part of your portfolio, but it’s a good idea to keep most of your investments in the stock market, especially if you are young. For reference, the average rate of return for the total stock market over time is about 9%.

Simplicity: While simplicity is definitely a good thing, you just don’t have many investment options. Actually, you just have one option – the bond portfolio that Worthy is currently offering at that point in time.Are

Are Worthy Bonds Safe?

In a nutshell, yes Worthy Bonds are safe – just as safe as any investment you’d make in the market. As I mentioned earlier, Worthy Bonds are only given to vetted borrowers who have their loans backed by assets that have a greater appraised liquidation value than the loan amount. In addition, the bonds are SEC qualified as well.

I’ll note that unlike banks, you do not have FDIC insurance on your money, but this is the same risk that you have with any money held outside of your bank.

Alternatives to Worthy Bonds

If you aren’t convinced, here are a few other non-stock market investments that you may find suitable alternatives to Worthy Bonds:

- Kiva: This peer-to-peer lending program lets you select who you choose to lend to. In addition, you can invest for as low as $25, and there are no loan servicing fees (which is not the case for most similar platforms).

- Fundrise: If real estate interests you, but you don’t want a big price tag, consider crowdfunded real estate. Fundrise does have a minimum investment requirement of $1000, but average returns have been around 9%. Note, the expectation is that you’ll invest for at least 5 years.

- Celsius Wallet: I know crypto currency sounds advanced, but with the Celsius Wallet, you can get up to 10.51% return on your investment in the crypto version of the US dollar (USDC).

FAQs about Worthy Bonds

After a period of being unavailable, Worthy Bonds are now available for purchase again through the app. As of August 2023, the available Worthy Bonds are Worthy Property Bonds and Worthy Property Bonds II. The Interest rate offered on both is 5.73%.

Worthy Bonds are a form of investment where individuals can purchase bonds that fund small businesses. These are accessible through the online platform Worthy Bonds.

In Summary | Worthy Bonds Review

In summary, per this Worthy Bonds Review, you should definitely consider adding Worthy Bonds to your overall investment portfolio. They are safe, easy to invest in, and have a solid rate of return. In addition, they will add income to your budget, allowing you to prioritize the fun things, like travel.

Click here to sign up for your Worthy Bonds account today!

Remember, you get a free bond by using this link!