What’s the Point of a Savings Account?

If you are anything like most Americans, you could probably save more money. This is something that can be difficult to do if you do not know where to start. In this post, we’ll answer the question: “What’s the Point of a Savings Account?”

At the end of this point you’ll have your answer and some alternatives to traditional savings accounts so that you can start saving like a pro.

The Definition of a Savings Account

According to dictionary.com, it is described as “a bank account on which interest is paid, traditionally one for which a bankbook is used to record deposits, withdrawals, and interest payments.”

A savings account is meant to protect your money from your regular spending habits, but still liquid enough so you can access the money when needed.

One thing to note here is that a savings account is not meant to be used as a wealth building tool. This means, it should not be used to to continually stash cash for the rest of your life. We’ll talk through this part a bit more later in the post, and where you should keep your surplus money for best results.

RELATED | 5 Easy Ways to Save More Money

4 Common Reasons for Opening a Savings Account

1 | To Build an Emergency Fund

The primary reason to use a saving account is to build an emergency fund. Think of an emergency fund as the place where you store money to cover any of life’s less-fun surprises. Everyone should have an emergency fund, as it guards against you having to use credit cards / debt to cover such expenses.

A general rule of thumb is to have six months of your budgeted expenses in your account if you are a single person, and three months of expenses (each) if you are married.

2 | To Save for Major Life Purchases

One reason why you might (temporarily) keep more than six months of expenses in your savings account is if you are saving for a major life event. Here are a few examples:

Home

If you are saving up for your first home, you must have at least a 3.5% down payment saved up for your purchase. (Note, this requirement could be less, for example, if you are a veteran or physician). It could be beneficial to save up to a 20% down payment, but you should weigh the costs of not investing that money to the additional amount on your monthly mortgage payment.

Weddings

If you do not expect to receive any “funding” from parents for your big day, you’ll need to save quite a bit for your wedding. The good thing? You have someone to share the expenses with. The bad thing? The average wedding cost in the US is around $40,000 these days. Now, there are definitely ways that you can drastically lower that price, you’ll just need to prioritize the budget as you plan.

Babies

We all know that babies / children are expensive. Those expenses can be particularly shocking with the birth of your first baby. One way to help with those expenses is with baby shower gifts, but that doesn’t cover everything, right? Your budget will definitely change as your family grows, so you should plan to save up for expenses like diapers, clothing, and bottles (if you plan to use formula). One green way to save on baby expenses is to use cloth/reusable diapers.

Cars

Cars are just not great investments. Period. Instead of looking to finance the nicest car out there, I recommend setting up a fund for a used car whenever you know you are getting close to needing a new one.

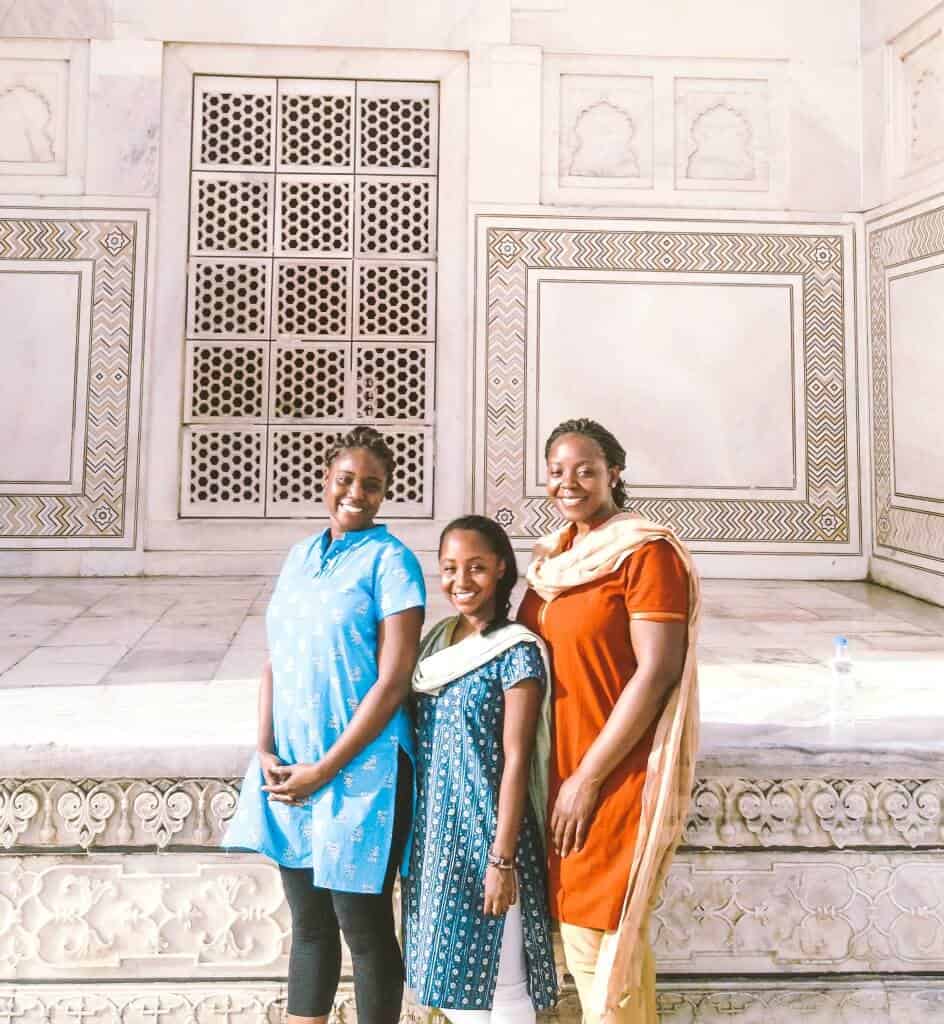

3 | Vacations

Vacations make life just so rich. That’s why a whole half of my site is dedicated to travel. You should take as many approaches as you can to save money on travel, but it should be a line item in your budget as well. This approach will permit you to put away the same amount each month for travel so that you always have enough for your next trip.

4 | Gifts and Other Non-Standard Purchases

Like the car and vacation funds, I recommend having a “gift” fund too. Being generous is something that we should all strive for – it’s better to give than receive after all, right? But put away a little every month so that you can always be ready to surprise your loved ones at the right time.

Common Savings Account Questions

Which Savings Account is Best?

The best way to answer this question is to start off saying which savings accounts are worse. The answer is easy: Pretty much any saving account that comes with your regular brick and mortar banks are terrible. So think banks like: Bank of America, Wells Fargo, Chase, etc. For reference, the average interest rate of most banks is just 0.07%. With rates like that, there is almost no point in using them.

The best savings accounts are usually those that are online only. Two that I personally use are Sofi Money and Ally Savings. I love both not only for their above-average savings rates, but their top-tier customer service and lack of ridiculous fees.

RELATED | SoFi Money Account Review

Which Savings Account Earns the Most Money?

I should first caveat that the impact of the pandemic on the economy caused banks to lower their interest rates. As a result, interest rates on the high-yield savings accounts (HYSAs) have decreased a bit too. In addition, the HYSA with the best interest is always shifting a bit. Current HYSA interest rates range from 0.25% – 0.60%. Check out this site for the latest on the best rates.

Are Savings Accounts Liquid?

Yes, savings accounts are liquid (which is the whole point actually). While it may take a day or so to transfer the money out (depending on the account), you can usually access your money pretty easily.

Can You Lose Money in a Savings Account?

You can’t necessarily lose money in your savings account, like you can in the market, but when the saving account interest rates are lower than the rate of inflation, your money will actually lose value.

To combat this, you should aim to increase your savings account according to the rate of inflation each year to keep up.

Are Savings Accounts FDIC Insured?

I can’t speak for each one, but the large majority of US bank savings accounts are FDIC insured. When signing up, you should just confirm with the FAQs / information provided by the bank first. For those FDIC insured, you will be insured for $250,000 per account.

Where Should I Keep Money After Reaching my Savings Goals?

After you hit at least three months of expenses in your savings account, your focus should start shifting more towards investing. I’d start by gradually investing more each month into your investment accounts.

One caveat – given the investment match given by most employers and the benefits of investing early, I recommend starting your 401K as soon as you can. Start by investing up to the match (or 5%), so that you do not leave money on the table.

Once your emergency fund is fully funded, you should shift entirely to putting money into your investments. We mentioned earlier that savings accounts do not help with wealth building, so if wealth building is your goal, investing is NOT optional.

Alternatives to Traditional Savings Accounts

If you have at least three months saved in your traditional savings account, you may want to consider putting your money in accounts that have higher interest rates. Here are a few options you can consider:

- Worthy Bonds: Use these to earn 5% on liquid (!) bonds! A great way to start investing as well. Learn more on my Worthy Bonds Review post

- USDC Token: Use platforms like Celsius to earn up to 12% on your cash investments. Note, unlike Bitcon, USDC is a stable coin, which means your money does not fluctuate

- Roth IRA: A very untraditional option, the Roth IRA is a great way to invest for the future and avoid tax penalties when taking your money out. Another lesser known option is that with the Roth, you can take out any money that you put in yourself without penalty as well (after a holding period).

In Summary | What’s the Point of a Savings Account?

The point of a savings account is to keep a liquid amount of cash available to you for emergencies and other important expenses. It should not be used for investments, but is a tool to prevent you from incurring debt. I hope that you now feel empowered to get out there and start your own savings account!