Chase Credit Card Rewards Redemption for Travel

I have had a lot of success in recent years using my chase credit cards to cover the costs of my travels. The chase credit card rewards redemption program is really great. In my opinion, and the opinion of some experts, the Chase Ultimate Rewards program is currently the best one out on the market. In this post I’ll cover the essentials of the chase credit card rewards redemption program and how you can use it to travel more!

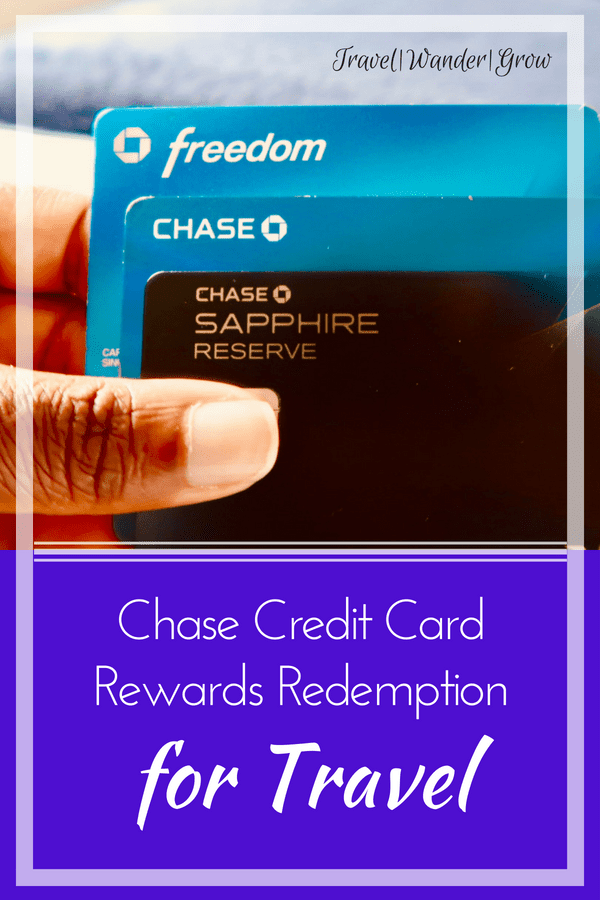

The Chase Credit Card Trifecta

The key to getting the most out of your chase credit card points is to not rely on just one card. Chase credit cards, like the cards offered by other banks, offer different amounts of points for different types of purchases. Because of this, you should have multiple credit cards so that you can maximize the points that you earn to the fullest. Over time, you should aim to hold the “Chase Credit Card Trifecta”, comprised of three of Chase’s top cards:

- Freedom Credit Card

- Freedom Unlimited Credit Card

- Sapphire Preferred OR Sapphire Reserve

Chase does offer other cards, of course, but these work well together in terms of collecting points as quickly as possible. Now, let’s dive into each card so you can see what they offer.

Overview | The Chase Freedom

The Chase Freedom was my first credit card with this bank, and still one of the most popular ones used by consumers. This card comes with the following benefits:

- $150 or 15,000 Points as a sign up bonus when you spend $500 in the first 3 months of opening your account

- No annual fee

- 5% Cash Back for up to $1500 spent on categories that rotate each quarter. These categories include everyday spending areas such as groceries, gas, and department stores. Every other purchase will earn you 1% Cash Back.

- Low intro APR of 0% for the first year, which then follows with a variable APR of 16.74% – 25.49%

- You don’t need a very high income nor very high credit score to qualify, which makes this an attractive card for new card holders.

Pay attention to that offer for 5% cash back, we’ll come back to that at the end of this post. If you in the market for a new card and this one interests you, click here to sign up!

Overview | The Chase Freedom Unlimited

The Chase Freedom Unlimited came out several years ago as a direct compliment to the Chase Freedom. I’ll show you what I mean below as I list out this card’s benefits:

- $150 or 15,000 Points as a sign up bonus when you spend $500 in the first 3 months of opening your account

- No annual fee

- 1.5% Cash Back on ALL purchases – It’s unlimited! 🙂

- Low intro APR of 0% for the first year, which then follows with a variable APR of 16.74% – 25.49%

- Like the Chase Freedom, you don’t need a very high income nor very high credit score to qualify

As you can see above this card offers many of the same benefits as the regular Chase Freedom. What makes this card the compliment to the Chase Freedom Unlimited is that you can now get 1.5% cash back for all the expenses where you would only get 1% from the Chase Freedom. This means with both cards, you’ll start earning points 50% faster than you would with just the Freedom. As neither card has an annual fee, that’s not a bad deal, right? Personally, this is my most used card as there are so many expenses that just fall into that “other” bucket.

If you are interested in signing up for the Chase Freedom Unlimited, you can do that now by clicking this link!

Overview | Chase Sapphire Cards

Okay, so to complete the Trifecta, you will need either the Chase Sapphire Preserve or the Chase Sapphire Reserve; two travel cards in Chase’s portfolio. You cannot really reap the full benefits of the trifecta for travel unless you have one of these two cards. The benefits for these credit cards are as follows:

- 50,000 Points as a sign up bonus when you spend $4000 in the first 3 months of opening your account. This is a value of $625 in travel dollars for the Preferred or $750 for the Reserve

- 2X Points (Preferred) or 3X Points (Reserve) on Travel and Restaurant Expenses

- Additional value when booking travel on the Chase Ultimate Rewards platform. The Preferred offers 25% more in value while the Reserve offers 50% more in travel

- No foreign transaction fees

- Travel & Purchase coverages

- 1:1 Point Transfer with airline & hotel partners

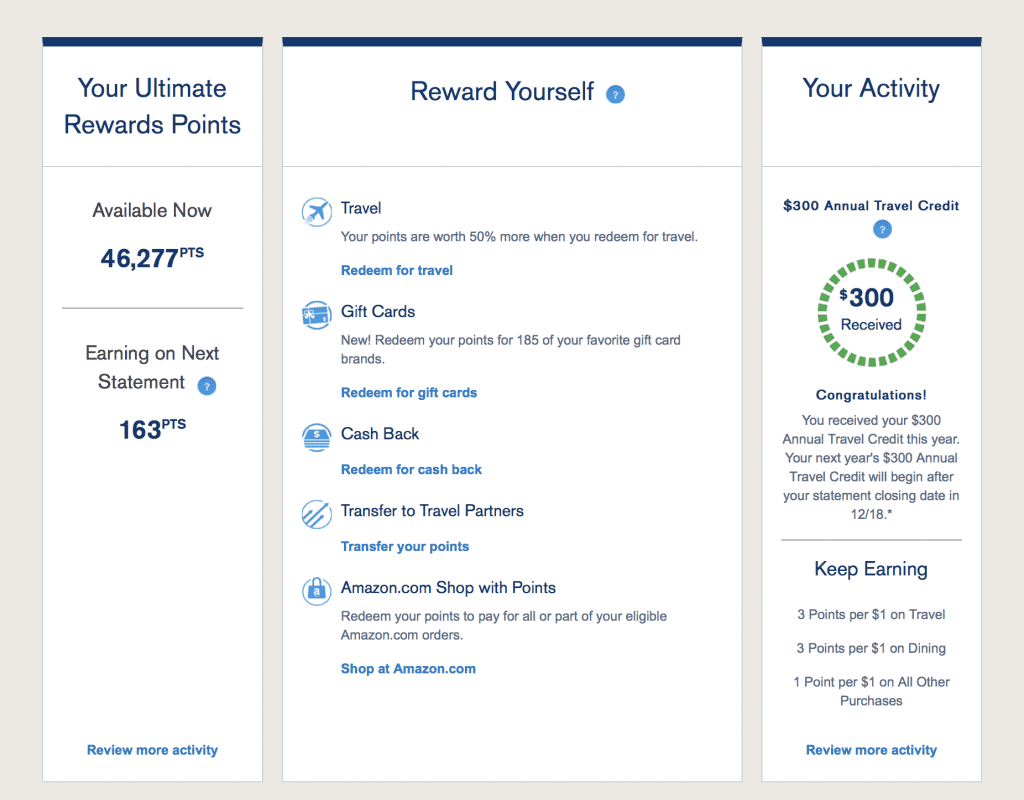

The main downside to both cards is the fact that both include an annual fee. The fee for the Preferred is $0 for the first year, but then $95 for every year that follows. The fee for the Reserve is $450, but the card does come with a $300 travel credit each year which helps offset the cost.

As you can tell from the description above, you don’t need both cards, but should weigh which card is best for you and your budget when considering which one to apply for. Read more on my review of the Reserve here, to get a clear idea if you should add that card to your wallet. If you have decided on the Preserve, you can apply for that one today here!

Chase Ultimate Rewards | Combining Points

So let me first introduce the Ultimate Rewards Platform, Chase’s platform which you can use to book travel or use your points in a variety of other methods. Of course, we’ll focus on the travel portion, but just know that the WORST way to use your points is to get cash back. You will always redeem points at a higher value if you use them on one of the way identified in the Ultimate Rewards platform. To give you an idea of what the platform offers, see below for a screenshot of the homepage:

The top of the page lays out other options for using your points. Note that my menu may be different from someone who does not have one of the travel cards. Additionally, if you do have a travel card, you’ll have a screen like the one below. The two options that I focus on are “Travel” and “Transfer to Travel Partners”.

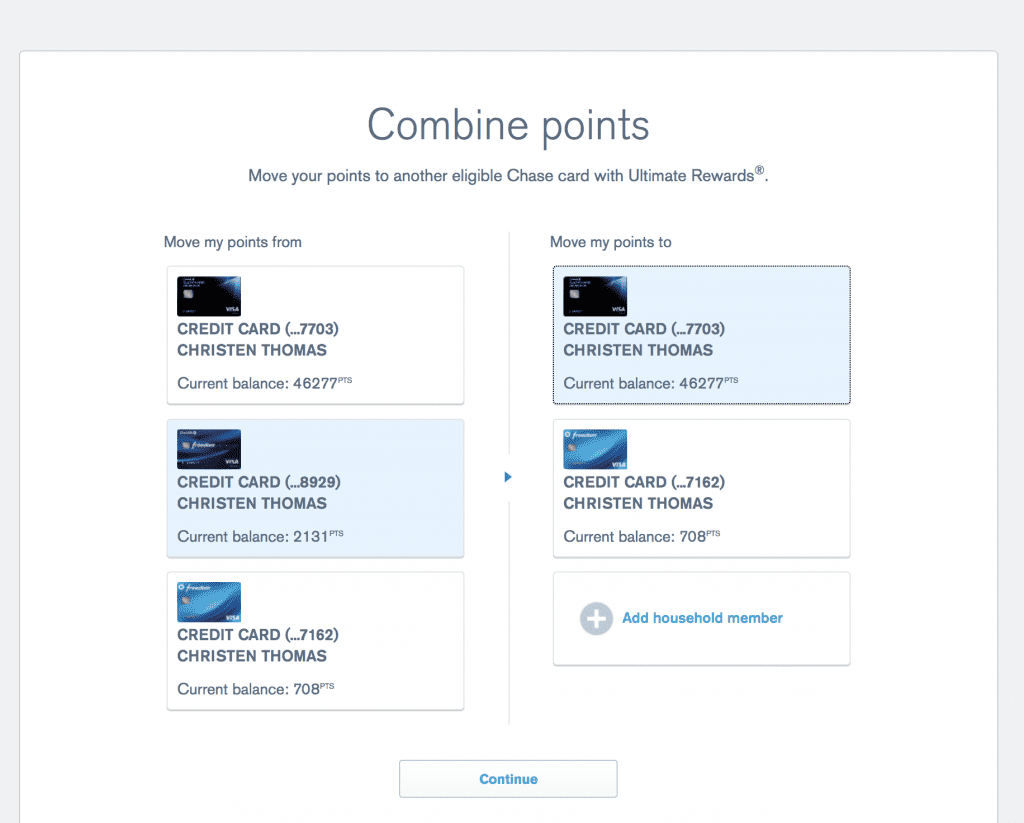

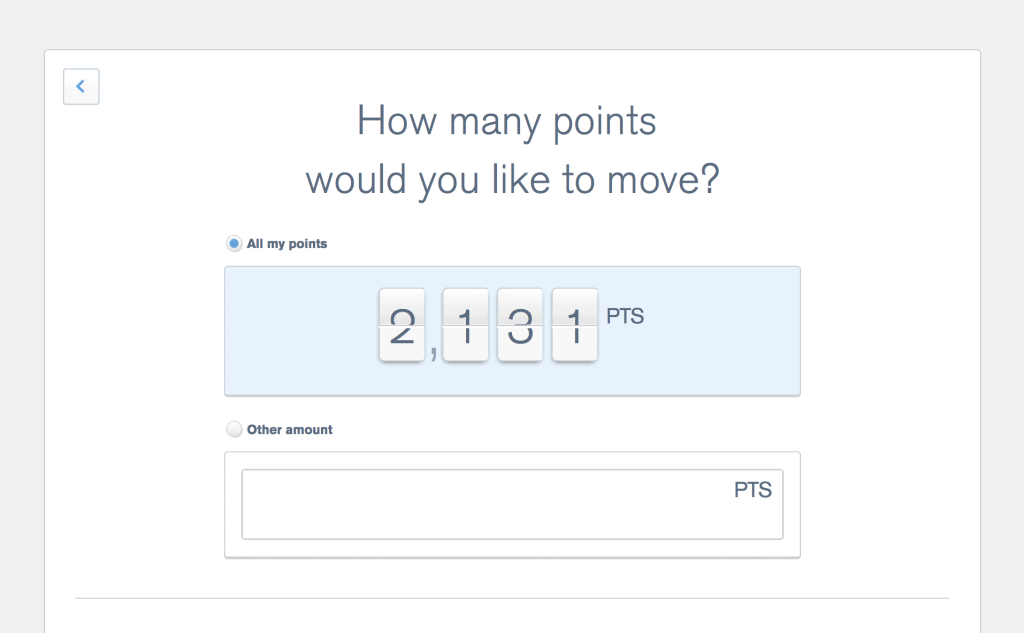

Once you have more than one card with Chase, you can start combining points! To get use those points for travel, I transfer all the points I earn on my Freedom and my Freedom Unlimited to the balance for my Reserve travel card. To do this you will select “Combine Points” from the header menu.

Once selected, you will then come to a page like the one below, where you can select the card you want to transfer points from and which card you’d like to transfer points to:

Once you’ve made you choice, you’ll then be taken to this page, where you can select the exact amount that you’d like to transfer. And voila, you’ve moved the points over! Not to worry, if you transfer to many / too little, you can always make a change before you use the points.

Chase Ultimate Rewards | Maximizing Points for Travel

To maximize your points to travel more, you simply have to remember when to use which card to get the most points on your purchase. I’m usually pretty good about using my Reserve for all things travel and restaurants, and my Freedom Unlimited for that “other” category. I will admit that I do sometimes forget which categories the Freedom is offering at a given point in time. But this page is helpful if you just need a quick reminder :).

In terms of which expenses I cover with my card, I typically use my points to cover airfare costs. You can certainly use the points to book hotels as well on the Ultimate Rewards platform, though! I tend to stay in AirBnb’s or boutique hotels which are a bit harder to find there, but it’s all a matter of preference.

As I briefly mentioned in the section above, the Ultimate Rewards platform also provides the option for you to transfer to travel partners with a 1:1 point ratio. These partners include Southwest, United, Virgin Atlantic, Marriott, Hyatt, and others. Sometimes this option saves you more points than booking with Ultimate Rewards, so do the math before you make your selection.

Wrapping Things Up | Chase Credit Card Rewards Redemption

So that wraps up my spiel on Chase Credit Card rewards redemption for travel! As I mentioned in my last Chase credit card post, with these cards it is extremely important that you pay your balance off at the end of every month. If you start keeping a balance and paying interest, that will negate the benefits of the points you receive. I hope you find this helpful as you look for ways to save money on your travels!

If you have any questions at all on how I use these cards, or have had success with them yourself, comment below!

#travelwandergrow

I am always in awe of people who can figure out the CC world lol… thanks for the indepth description with screenshots to match… I already have one of those cards, so I will definitely look at this again.

Hi Gail! It took a lot of research and trial and error to get here, but so glad you found this post helpful! If you have questions, just let me know!

I needed this article! Thanks for all the tips! Can’t wait to get spending and traveling!

Happy to help, Laura! 🙂

Your blog is beautiful! I just came back from Athens, Santorini, Rome, Dublin, and London with our 9 month old! Can’t wait to do it again!

That sounds awesome! And I’m so impressed that you did that with a 9 month old!! And I haven’t tried Dublin yet, so definitely on my list 🙂

We are super big in using our rewards points for travel. As a family of five, it helps make all the travel affordable. We love this program!

That’s great- always glad to meet other Chase users! I’m 100% sure I would only be able to take half the trips I do now without this program.

Thanks for this! I’ve been looking into travel credit cards, and this information definitely helps.

Glad you found the post helpful, hope you can sign up for your new card soon!!

I absolutely love Chase! When I travel, I never leave home without a Chase credit card. I”ve been with them for more than five years now…no turning back.

Same here!! 🙂